Media Releases

EVs need incentives to drive decarbonisation

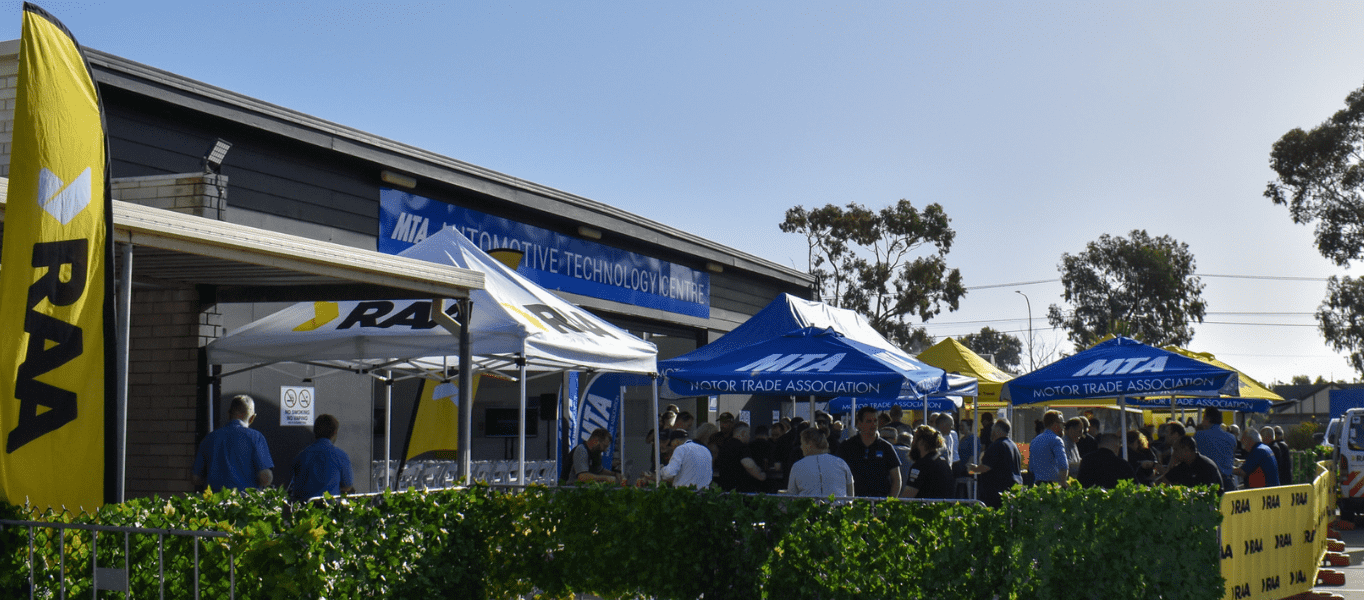

The Motor Trade Association SA/NT (MTA) is calling on the State Government to bring back incentives for electric vehicles, as well as expand incentives to other zero and low emission vehicles as part